The Debt Ceiling in Simpler Terms

The debt ceiling is a limit that Congress sets on how much debt the U.S. federal government can have. It's like a credit card limit that your bank gives you.

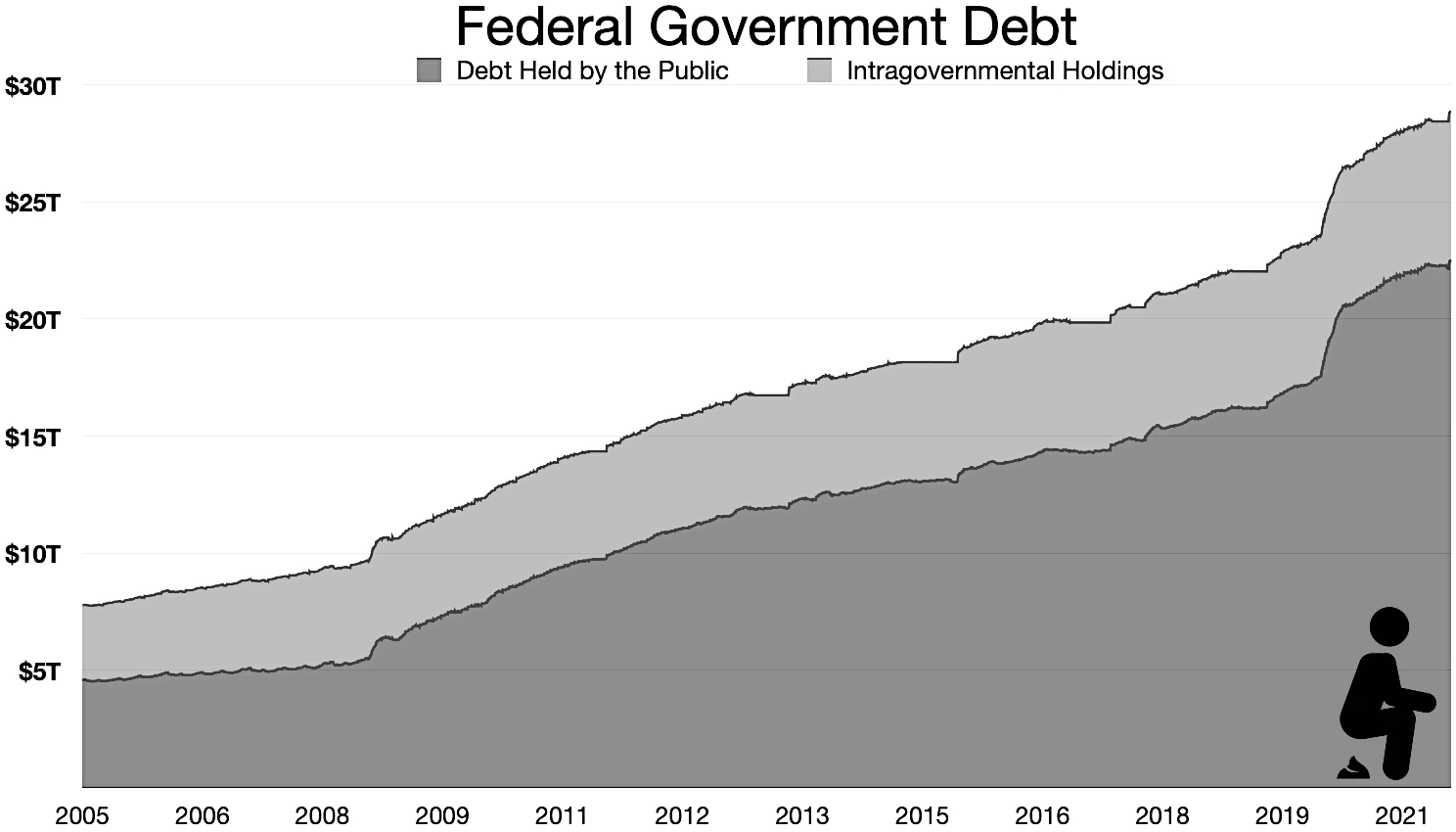

Now, why does the government have debt? It's because the government often spends more money than it takes in from taxes. The difference between what it spends and what it receives is called the "deficit." The government borrows money to cover this deficit by issuing bonds, which are bought by individuals, businesses, and other countries. All of these deficits add up over time to form the "national debt."

The debt ceiling is important because if the U.S. hits this limit, the government technically can't borrow any more money. This can lead to a lot of problems. The government has many ongoing obligations, like paying the salaries of government employees, supporting the military, paying social security, and more. If the debt ceiling isn't raised, and the government runs out of money, it might not be able to fulfill these obligations. This is what's often referred to as a "default."

If the U.S. were to default, it could have serious consequences, not just for the U.S., but for the global economy. The U.S. government's debt is considered one of the safest investments in the world. If that were called into question, it could cause financial turmoil.

So if the debt ceiling is such a problem, why have it at all? Some people believe it's a good way to check government spending and enforce fiscal responsibility. If the government wants to raise the limit, it has to go through a public and often contentious debate, which could theoretically lead to spending cuts or tax increases.

In practice, however, the debt ceiling has been raised many times throughout history, often after a lot of political wrangling. In some years, the discussions about the debt ceiling have led to a lot of uncertainty, and in a few cases, even a temporary shutdown of some government services. But so far, the ceiling has always ultimately been raised before a default occurred.

The economic Philosophy of The Debt Ceiling

The debt ceiling is a concept grounded in the economic philosophy that government borrowing should be limited to prevent excessive indebtedness and fiscal irresponsibility. The underlying idea is that too much national debt can have harmful economic effects, such as crowding out private investment, causing higher interest rates, potentially leading to inflation, and ultimately burdening future generations with repayment obligations.

Here's the basic theory on how the debt ceiling is supposed to work:

- Limit on Borrowing: The debt ceiling sets a cap on how much money the federal government can borrow to finance its operations and meet its obligations. The idea is to limit the accumulation of new debt, thereby encouraging fiscal responsibility and sustainable economic policy.

- Congressional Oversight: The debt ceiling gives Congress a chance to review and debate the country's fiscal policy. Whenever the debt ceiling needs to be raised, it forces a discussion about the government's spending habits, revenue collection, and overall fiscal health. This can lead to policy changes designed to decrease the deficit and, therefore, the need for additional borrowing.

- Public Accountability: The process of adjusting the debt ceiling is public and often widely covered by the media. This can serve to hold elected officials accountable to the public for the country's fiscal policy.

However, in practice, the debt ceiling has often been more of a source of political contention than a useful tool for fiscal responsibility. It has not effectively curbed government spending or the growth of national debt, as the ceiling has been raised dozens of times throughout its history to accommodate increasing debt levels. It has, at times, led to serious political impasses that have created financial and economic uncertainty.

Economists and policy experts often debate the usefulness and potential drawbacks of the debt ceiling. Some argue for its abolition, noting that other mechanisms, such as the annual budget process, can serve to control spending and that the risks of a potential default are too high. Others believe it serves a crucial role in sparking necessary debates about fiscal policy and government spending.

How does the Debt Ceiling affect The Stock Market

The debt ceiling can have a significant impact on the stock market, mostly due to the uncertainty it creates. Here's how it works:

- Investor Uncertainty: When the U.S. approaches its debt ceiling, it creates uncertainty about the government's ability to meet its financial obligations. Investors don't like uncertainty. If investors are unsure whether the government can repay its debts, they may sell off their stocks and bonds. This selling can drive prices down, causing the stock market as a whole to fall.

- Risk of Default: If the U.S. were to default on its debt because the debt ceiling isn't raised, this would likely cause a significant drop in the stock market. A default could lead to higher interest rates and reduced confidence in the U.S. economy, both of which are negative for stock prices. The U.S. Treasury bonds are considered one of the safest investments in the world, and a default would call that into question, potentially causing a major financial crisis.

- Economic Impact: Discussions around the debt ceiling can sometimes lead to other measures like government shutdowns if a budget isn't agreed upon. These can have a broader impact on the economy. For example, during a government shutdown, some public services may stop, and government workers may not get paid. This could slow down economic activity, which in turn, could negatively impact corporate earnings. Lower earnings can translate into lower stock prices.

- Interest Rates: The debate surrounding the debt ceiling could also affect the Federal Reserve's decisions on interest rates. If a default looks likely, the Fed might decide to raise rates to attract more investors. Higher interest rates can make borrowing more expensive for companies, which can reduce corporate profits and lead to lower stock prices.

It's important to note that these are potential scenarios. So far, despite the many debates and delays around raising the debt ceiling, the U.S. has never actually defaulted on its debt. Nevertheless, the uncertainty and risk associated with the debt ceiling can lead to increased volatility in the stock market.

How does it affect regular people

The debt ceiling can potentially affect regular people in several ways, mostly through its impact on the economy:

- Government Services and Payments: If the debt ceiling isn't raised and the government runs out of money, it could mean delays in payments for things like Social Security, Medicare, and military salaries. Additionally, some government services might be shut down, which could impact everything from national park access to passport services.

- Interest Rates: Interest rates could go up if investors start demanding a higher return for the increased risk of holding U.S. debt. This could affect regular people in the form of higher costs for things like mortgages, car loans, and credit card debt.

- Economy and Jobs: A default, or even the serious risk of one, could have negative effects on the broader economy. This could lead to a slowdown in economic growth or potentially a recession, which could lead to job losses and lower wages.

- Investments and Retirement Accounts: If you have investments, like in a 401(k) or an individual brokerage account, the value of those investments could be impacted. Uncertainty around the debt ceiling can lead to volatility in the stock and bond markets, which could decrease the value of your investments.

- Inflation: If the government is unable to borrow money and decides to print more money to meet its obligations, it could lead to inflation. This would mean the purchasing power of the money you have would decrease, and the cost of goods and services could rise.

It's important to note that while these scenarios are possible, they are also worst-case scenarios. Historically, despite the debates and delays, the debt ceiling has always been raised before the government exhausted its ability to pay its obligations, and the U.S. has never defaulted on its debt.

Recommended reading on the Debt Ceiling

Here's a list of books, articles, and other resources that can help you understand the debate around the debt ceiling:

- "White House Burning: The Founding Fathers, Our National Debt, and Why It Matters to You" by Simon Johnson and James Kwak: This book explains the history of the national debt, a topic closely linked to the debt ceiling, and discusses its impact on policy debates.

- "The Price of Politics" by Bob Woodward: Woodward focuses on the battle over the debt ceiling under President Obama in 2011. It's a good case study of how these debates typically unfold.

- "The Debt Limit: History and Recent Increases" - Congressional Research Service: This is a report, but it's a good resource if you want a detailed history of the debt ceiling, including data on how and when it has been raised in the past.

- "The Debt Ceiling: Why we have it, and what would happen if it died"- The Washington Post: This article explains why the debt ceiling was created and debates the pros and cons of keeping it.

- "Why the Debt Ceiling Is the Most Dangerous Thing in American Politics"- Time Magazine: This article discusses the potential dangers of the debt ceiling debate.

- Planet Money Podcast "The Debt Ceiling": Planet Money explains complex financial topics in an understandable way. They've done several episodes on the debt ceiling, which you might find helpful.

- "Debt Ceiling 101"by Khan Academy: This is a video that explains the debt ceiling in straightforward terms. Research Papers:

- "The Macro Effects of the Recent Swing in Financial Conditions"- by the Federal Reserve Bank of New York: This research discusses the macroeconomic impacts of financial conditions, including the risk premium on US debt, which can be influenced by the debt ceiling debate.